When it comes to financial planning, this time of year feels like everything is moving so fast. March has marched on in, and the financial year end is just around the corner. That’s a big thing for us accountants. Work is flat out till 30 June, and we look forward to the Financial New Year party – though sadly, no fireworks for us.

Now is the time to think about making the most of opportunities to plan your tax situation for the 2024-year end. I think there will be something for everyone in the year end planning issues below. This year, June 30 is on a Sunday, which makes Friday 28 June 2024 that last effective day of the year. Please talk to your advisor sooner rather than later and don’t leave it till 28 June 2024, we can’t do anything for you then!

For Businesses

- The Instant Asset Write Off limit is $20,000 for business with a turnover of less than $10M. Items of plant and equipment costing less than $20,000 can be claimed as a deduction in full. Items over $20,000 can be depreciated at 15% in the first year and then 30% each year after that.

- Businesses with a turnover of more than $10M will need to depreciate assets over their effective life.

- Pay employee super before 30 June 2024 for a tax deduction in the 2024 year. NOTE that super payments must be processed by the clearing house and funds sent to super funds for the deduction to apply. Most clearing houses say it takes 10 days to process super payments, so pay no later than 17 June 2024. Hint, estimate super payments to 30 June 24 for the biggest deduction.

- Pay or document any employee bonuses before 30 June 2024.

- For small businesses with turnover less than $50M, you can prepay rent and other business expenses for up to 12 months.

- Attend CPD training or prepay for training in the next 12 months.

- Review debtors and write off any bad debts before 30 June 2024.

For Trusts

- You must do trust distribution minutes before 30 June 2024 to allocate profit for the year. To make these decisions you need to forecast what your profit is likely to be for the year. Once your March 2024 BAS is completed, review the results for the year to date and estimate profit for the year.

- Consider Div 100A when allocating profit to adult beneficiaries.

- Consider the use of companies as beneficiaries.

For Companies

- If your company turnover is less than $50M, the company tax rate for the 2024 year is 25%.

- The rate for companies not operating a business or with turnover above $50m is 30%.

- Consider how you will take profits out of the company, either as wages or dividends. Wages will have super and workers comp issues. Dividends need company tax paid to take out fully franked dividends.

For Individuals

- If making a personal super contribution make sure you do your Notice of Intent to claim a tax deduction form with your super fund. If the form is not lodged with the super fund, you will miss out on your tax deduction.

- Review expenses for the year to pick up all deductions related to work, self-education, travel, motor vehicles (if you use your car for work purposes) and donations.

- Do a new logbook now if yours is more than 5 years old or your pattern of work use has changed. Logbooks need to be started before the end of the tax year.

- Consider FBT exempt/salary sacrifice arrangements for work related electronic devices such as laptops, computers, digital cameras, mobile phones.

- Home office expense claims have two options. The ATO fixed rate method at 67c per hour plus depreciation on plant and equipment or your actual expenses. Keep receipts for plant and equipment and running costs, and records of the number of hours you worked from home.

- Review life and income protection policies for appropriate insurance amounts and tax deductibility.

- If you have rental properties, review expenses for the year and prepay any to get larger tax deductions this year. Review loans to check on rates of interest you are paying. If you have not reviewed your loans in the last 2 years, do so now with your bank or mortgage broker.

- If you have an agent managing your rental property, get them to pay all property expenses, so that they are recorded on one statement at year end for your accountant.

- Consider the sale of any assets and what capital gains tax implications there might be. Note that for tax it is the contract date, not the settlement date, that is important for tax. Do you have capital losses available to offset gains?

Superannuation

There are several types of contributions you can make to your super fund. As I’ve previously written, super is the most tax effective way of saving for retirement. The 2024-year limits on super contributions are:

- Concessional (deductible) contributions are capped at $27,500. The limit includes personal and employer contributions.

- Non-Concessional (non-deductible) contributions are capped at $110,000 per year, if your balance is less than $1.7m.

- Members of super funds under 75 years of age can make contributions of up to 3 times the $110,000 limit. The “bring forward” contributions can be a great retirement planning strategy.

- If you have not made maximum contributions in the past, the unused balance will carry forward for 5 years, if the balance of your super fund is less than $500,000. The unused caps can be very powerful if you have a larger than normal income year to get large tax deductions. Note the amounts carried forward will expire after 5 years. The first year for the unused concessions was 2020, so past limits will soon expire.

Other strategies for super contributions include:

- For couples, aim to have similar balances in super at retirement, rather than one spouse with a high balance and one with a low balance. Re-contribution strategies can help with this but need advance planning.

- Spouse contributions if a spouse has a low or no income.

- Downsizer contributions don’t miss out on this if you are selling your home. You only have 90 days from settlement to make the contribution.

- Government co-contributions for low earning employees. The government will contribute 50 cents for every dollar of after-tax contributions you make to your fund, up to $500 if your income is less than $42,016. It phases out where adjusted taxable income is between $42,016 and $57,016. This could be a strategy to build early super balances for working children.

Strategy around the timing and type of super contributions can be very powerful for tax and retirement planning. However, if you get it wrong there are also significant penalties. Please discuss this with your advisor before making contributions.

2025 Changes & Future Planning

- Super Guarantee (SG) payments will increase for employees to 11.5% of ordinary time earnings from 1 July 2024. SG amounts will increase again on 1 July 2025 to 12%.

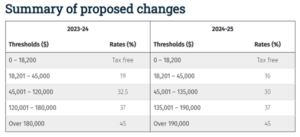

- Individual tax rates change from 1 July 2024. The 2024-year rates and the proposed individual tax rates for the amended Stage 3 tax cuts are below.

For advice on tax planning and year end please give me a call.

About the author

Chartered Accountant and Director

Ecovis Clark Jacobs

Accounting and Business Advisers

This article first appeared in the March 2024 issues of the News Bulletin, published by the Australian Dental Association https://www.ada.org.au/Dental-Professionals/Publications/News-Bulletin